prince william county real estate tax due dates 2021

To help businesses impacted by the economic impact of COVID-19 the County has extended the Business Tangible Personal BTP Property tax filing deadline from April 15 2021 to May 17 2021. A convenience fee is added to payments by credit or debit card.

2022 Best Places To Buy A House In Prince William County Va Niche

Tax amount varies by county.

. Other public information available at the real estate assessments office includes sale prices and dates legal descriptions descriptions of the land and buildings and ownership information. Second-half Real Estate Taxes Due. When are property taxes due in Virginia County Prince William.

During the July 14 meeting the Prince William Board of County Supervisors voted to defer payments for the first half of the real estate taxes due on July 15 2020 until Oct. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday. Monday September 5th 2022 Labor Day.

Prince William County collects on average 09 of a propertys assessed fair market value as property tax. If the real estate tax rate remains the same the homeowners taxes would go up. To help businesses impacted by the economic impact of COVID-19 the County has extended the Business Tangible Personal BTP Property tax filing deadline from April 15 2021 to May 17 2021.

Payment by e-check is a free service. New Applications for Tax Relief for Elderly Due Commissioner of the Revenues Office July 1. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct. Provided by Prince William County Communications Office. August 1 Tax Relief for the Elderly and.

For example a home valued at 400000 in 2020 would be worth 428000 for tax purposes in 2021 at a 7 increase. 1 be equal and uniform 2 be based on up-to-date market value 3 have one appraised value and 4 be. Report a Vehicle SoldMovedDisposed.

Starting March 1 2021 interest at 10 per annum begins to accrue on any unpaid amount of this real estate tax for the second half of 2020. The citys carrying out of real estate taxation cannot infringe on the states constitutional regulations. Annual State Income Tax Returns Due.

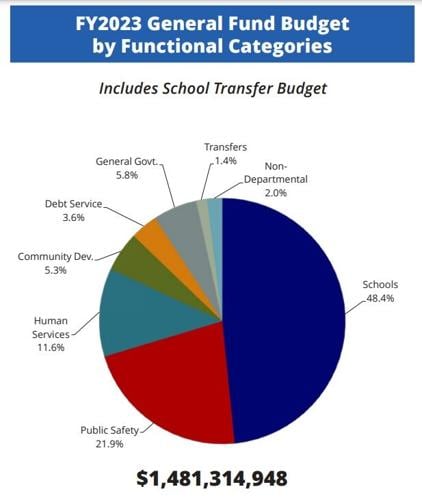

Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the. Prince william county real estate tax due dates 2021 Monday May 30 2022 Edit Prince William County Budget Set For Approval Residents. Prince william county real estate tax due dates Wednesday July 6 2022 Edit First Pageland Lane Data Center Plan 7 900 000 Square Feet Headlines Insidenova Com.

The second half of real estate tax payments are still due on december 6 2021. Personal Property Taxes and Vehicle License Fees Due. Taxation of real property must.

Monday July 4th 2022 Independence Day. Banks will accept payments from May 1st through June 1st the First Installment due date. Prince William County Real Estate Taxes Due July 15 2022.

Make a Quick Payment. The treasurers office is working diligently to have bills mailed next week. The county is proposing a decrease in the residential real estate tax rate from 1115 per 100 of assessed value to 105.

Report a New Vehicle. For all due dates if the date falls on a Saturday Sunday or County holiday the due date is extended to the following business day. Personal Property Taxes Due Real Estate Taxes Due.

You will need to create an account or login. First Half Real Estate Taxes Due Treasurers Office June 15. Report a Change of Address.

Personal Property Taxes Due Real Estate Taxes Due. Provided by prince william county. Penalties and interest continue to apply and accrue on past due installments.

Monday May 30th 2022 Memorial Day. COLLECTION PERIOD TIME FRAME. July 2 2022.

The second and all subsequent installments are due on the 5th of each month with the final payment being due on June 5th. Report changes for individual accounts. Prince william county government virginia.

Does NOT extend the amount of time to pay your tax due May 1 Estimated state income payments due May 1 June 15 September 15 January 15 All tax due extended filings must be submitted November 1. Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date. If you have questions about the real estate assessment process please contact the Real Estate Assessments Office at 703-792-6780 or email protected.

The first monthly installment is due July 15th. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Prince william board of supervisors extends real estate tax payment due date to october 15.

And from August 1st through. FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or Holiday the due date or deadline is the following business date. The County cannot issue refunds to taxpayers who have already voluntarily paid their real estate taxes for the second half of.

Business License Tax Due Treasurers Office September 15. May 1 760IP Individual payment for automatic extension of estimated tax due. Business License Renewals Due.

Estimated Tax Payment 2 Due Treasurers Office June 30. June 24 FOR 2022. State Income Tax Filing Deadline State Estimated Taxes Due Voucher 1 June 5.

Estimated Tax Payment 1 Due Commissioner of the Revenues Office June 5.

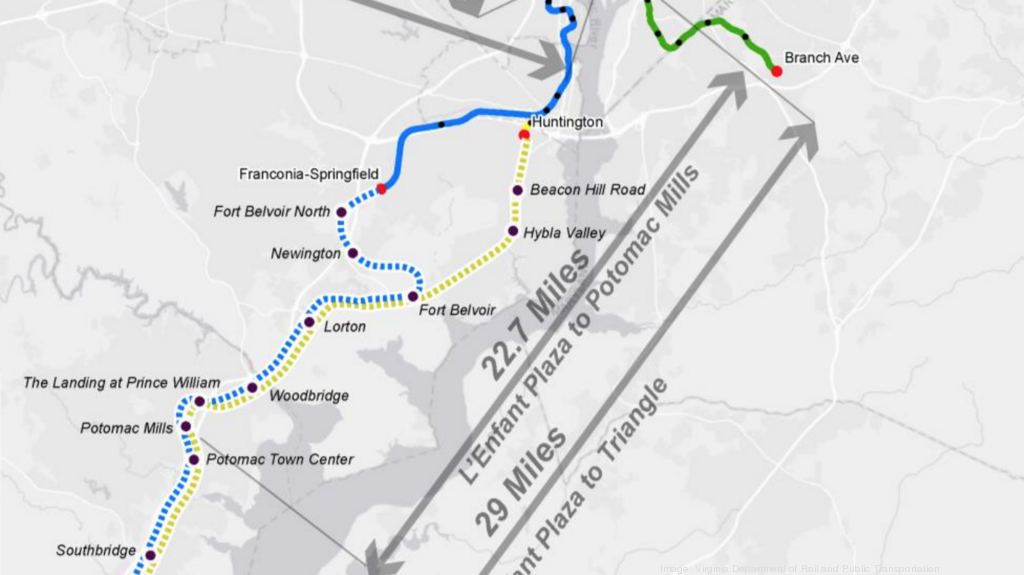

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal

Prince William Board Of County Supervisors Adopts Fy2023 Budget Prince William Living

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Headlines Insidenova Com

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Data Center Opportunity Zone Overlay District Comprehensive Review

Deadline Extended To Pay Real Estate Taxes For Second Half Of 2020 Prince William Living

New 800 Acre Data Center Campus Proposed In Prince William County Virginia Dcd

Welcome Back Prince William County Police Department Facebook

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Here S How Metro Would Change Prince William County Development With A Quantico Extension Washington Business Journal